In most fairy tales, the way out of the dark forest is the way in -- in reverse. Sometimes the hero of the story will take care when entering the bewildering forest to lay out the way back by leaving behind markers, beans strewn on the ground, so he will not forget the entrance and exit routes. The moral of all these tales is the same: if you’ve make a mistake, reverse your errors. It is a lesson politicians in Connecticut might take to heart. With a little courage and the virtue of foresight, the lucidity of remembrance brought to bear on current difficulties, there is no difficulty that cannot be overcome.

In a recent piece in National Review,

senior fellow at the Manhattan Institute Stephen Eide gives us a summary view

of Connecticut’s weaknesses. The top marginal income-tax rate in Connecticut now

stands at 6.99 percent, Eide writes, “almost two points higher than the 5.1

percent in neighboring Massachusetts. The income tax has generated a flood of

new revenues — $126 billion over 25 years, according to the Hartford-based

Yankee Institute for Public Policy — but somehow state lawmakers neglected to

direct adequate funds to the pension system. As a consequence, Connecticut’s

state employees’ retirement system is funded at only 35.5 percent, one of

lowest rates in the nation. Despite a slew of recent tax increases, state

government now faces deficits of $1.5 and $1.6 billion in the next two fiscal

years.”

Such is Connecticut’s forest, dark and dank. As grown-ups,

we should candidly admit that marginal tax rates do not increase automatically;

they are raised over time by people who do not perceive the connection between

high tax rates and diminishing revenues. President John Kennedy did understand the connection, which is why he proposed in a speech studiously

ignored by Democratic progressives in Connecticut to reduce marginal tax rates

for the express purpose of boosting federal revenue. His reductions fueled

business expansion, which flooded federal coffers.

The flood of new tax revenue mentioned by Eide -- $126 billion

over 25 years – was misused by politicians who chose not to “direct adequate

funds to Connecticut’s pension system.” Connecticut presently “faces deficits

of $1.5 and $1.6 billion in the next two fiscal years” because spending has

outstripped revenue collection, despite historically large tax increases. After

the imposition of a state income tax in 1991, after Governor Dannel Malloy

imposed on Connecticut both the largest and the second largest tax increases in

state history, deficits continue to pile up – because spending follows in the

wake of tax increases: the more you get,

the more you spend. So, where’s the exit?

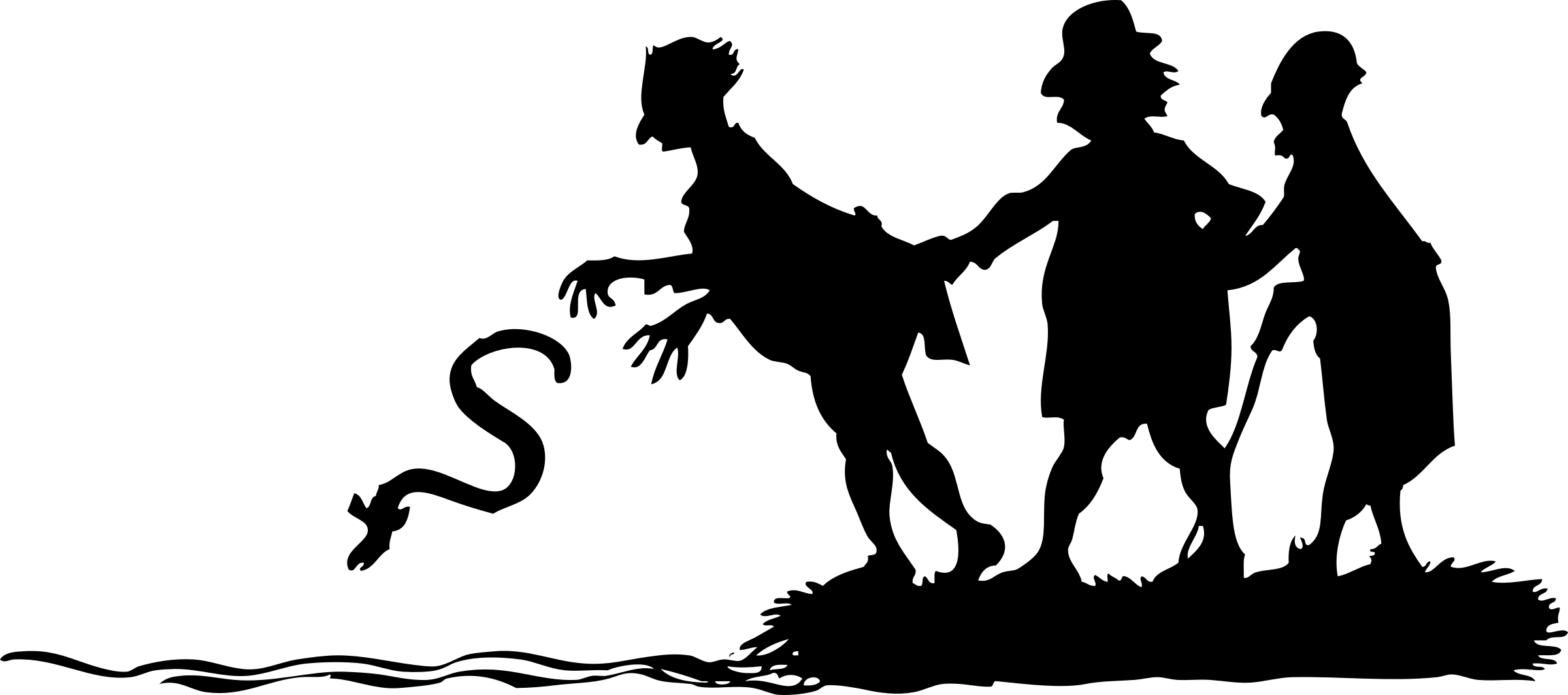

It should not take the wise men of Gotham to propose the

proper remedy for what ails us – cut spending, “a thing easy to say, but hard

to do,” as the fairy tales continually remind us. It turns out in the fairy

tales that the wise men of Gotham sometimes come up short on sensible

solutions. Having decided to raise money by establishing two ponds and filling

both with sell-able fish, the wise men of Gotham one day discover that a large

eel had decimated one of the ponds.

“A mischief on this eel, for he has eaten up all our fish. What

shall we do with him?”

The wise men take council with each other. One says, “Kill

him!” Another advises, “Chop him into pieces.” A third says, “No so. Let’s

drown him!” All say, “Be it so!” And with that the eel is taken from the pond

where he has eaten all the fish and thrown into the second pond full of fish,

where he is left, so the wise men of Gotham think, to drown. This is not, wise

men of Connecticut will agree, a fit solution to the problem.

For a quarter century, Connecticut politicians, mostly progressive

Democrats tied to the iron apron strings of state employee unions, have been

throwing the eel back into the fish pond, thinking in this way they might drown

the troubles of the state. It hasn’t worked, it cannot work, it will not work.

Following the imposition of the Lowell P. Weicker income tax in 1991 and Malloy’s

two crippling income taxes increases –tax increases that have twice prolonged

national recessions and offered irresistible inducements to boost spending –

our state, somewhat like Malloy’s approval ratings, is scraping the bottom of

an empty barrel. And there is little indication that Malloy or other Democratic

progressives, operating from a failed economic model, have even bothered to

read the writing on the wall, which plainly calls for permanent tax and spending reforms.

Comments